How to Import From China to the UK

Learn how to calculate all import duties into the UK.

How to import from China to the UK

How To Calculate Import Duties And VAT Using The UK Trade Tariff System And Know Your Duties And VAT.

Hey there! Today, we’re diving into a topic that might not sound super exciting but is crucial: How to import from China to the UK. We’re going to focus on something a bit less glamorous but super important—calculating VAT and duty when bringing goods into the UK. Consider this your ultimate guide for navigating the ins and outs of importing from China to the UK and figuring out the nitty-gritty details of import duties and VAT.

Thinking back to when I was setting up Merchsprout and getting into the whole importing scene from China to the UK (and dealing with various companies in the past), it felt like a real puzzle. I mean, we’re talking about stuff like companies house, VAT, HMRC, shipping, and import—definitely not the most straightforward subjects!

I spent ages scouring the internet, trying to find real, practical info on importing stock from China to the UK. But guess what? It was like searching for a needle in a haystack. There was a ton of advice on finding products and sourcing them (though not always accurate), but not much on the nuts and bolts of importing and shipping.

So, I decided to take matters into my own hands and create a video to break it all down for you. Check out my guide on “How to import from China to the UK” where we get into the details and make this whole process way less daunting. Let’s tackle the importing world together!

Contact Us Now

Why do we want to know about customs, duty and VAT Charges?

Ever wondered why bother with the nitty-gritty of importing, duty, and VAT calculations? It’s all about building a profitable business and making sure you save money while being super efficient.

In today’s ultra-competitive world, especially on platforms like Amazon where everyone’s fighting for a piece of the pie, understanding these details is crucial. It’s about knowing every step your components take to get to you or your buyer – making sure it happens fast and meets your quality standards.

At MerchSprout, we’re all about taking the time to dig into topics like defining requirements and ensuring suppliers understand every bit of what you expect. We’re meticulous because those details matter.

On our YouTube channel and website, we’ve got a treasure trove of info, guiding you on How to import from China to the UK, helping you snag the stock you want from suppliers, and giving you tips on picking the right ones.

So, picture this: you’ve found a stellar product in China, got it made, and it’s shipped FOB to your vessel. This is where our expertise kicks in, making sure you smoothly navigate every step and get the most out of your importing adventure.

Different Incoterms Explained

Alright, let’s chat about Incoterms, especially when you’re bringing stuff from China to the UK. There are different shipping terms, and your choices depend on how much you want to handle and what you’re willing to spend when importing from China to the UK.

Now, focusing on importing from China to the UK, let’s look at a couple of options commonly used by Chinese suppliers. First up is Ex-Works, also known as the factory price. Here, the factory makes the stuff and leaves it outside their door (figuratively speaking). So, you’re in charge of everything – from shipping to the port, getting it through customs, loading the ship, and finally, shipping it to your country, the UK. Plus, don’t forget the import duties and VAT payments tied to importing from China to the UK.

Doing all this yourself is quite a task, especially if you’re new to importing from China to the UK. But, if you’ve done some sales before or have reliable connections in China, it could work out, especially when importing from China to the UK.

Now, why might you want to consider this way of importing from China to the UK? Well, it opens up more options for where you get your stuff – not just limited to factories with export licenses when importing from China to the UK. So, when you’re importing from China to the UK, it’s worth exploring your options.

FOB- Free On Board

The next term of shipping, and by far the most common, is FOB.

FOB stands for Free on Board; it always makes me smile a little bit. Free makes you sound like you are getting something for free. But as with everything in the world, nothing is free.

Free onboard means that the supplier will make the products for you, load the container, use their export licence to conduct customs clearance on the items and load the items onto the boat. At which point, you take ownership of the components and the responsibility of shipping and insurance and subsequently import, duty and VAT.

FOB is the most frequently offered by suppliers, and its what we will be using for our assumptions in the latter part of this explanation.

DDP- Delivery duty paid

But there is one more shipping option that we will be just having a brief comment on, and that’s DDP. This stands for delivery duty paid. It’s the simplest but most expensive way to ship components from your supplier to you and usually only implemented when shipping smaller items such as samples or smaller batches of parts. The parts are shipped directly to you by the manufacturer shipping is included, as is duty, usually insurance, and VAT.

However, have a look at this video to see why we don’t always advise using DDP when shipping larger batches of parts.

For the sake of this explanation, and because it’s the most common and the most efficient way, we will be discussing FOB shipping terms.

So you have had your parts made, now what?

When the production of components is complete, your supplier should inform you to arrange for an inspection agency to look at the pieces and get their approval. Then request that the inspection agent monitor the container’s loading and release the 70%/50% of the funds that you were withholding (or your inspection team/ third party) were withholding.

Then, the components will be shipped to the port of exit by the shipping company arranged by the supplier. The supplier’s shipping company will arrange the clearance through customs and discuss the shipment details with your freight forwarding agent.

If you need assistance with a freight forwarding agent, please drop me a message or leave a comment and I can advise you on any shipping agents that I use and any queries that you may have.

Usually, the supplier has provided an invoice with an HS code (harmonised standard). Make a note of this code as it is what you will use to calculate your duty clearance costs.

As you can see, it’s not hard, as explained, to get stock out of a manufacturing facility onto a boat and out to sea. It’s one of the easier things in the entire supply chain.

Important things to remeber before exporting from china and your supplier

- Ensure that your stock is correct, signed off and inspected before allowing the parts to leave the facility. Once those parts have left the facility and in the container, no rectifications can be born by the supplier.

- Ensure that you have someone monitoring the loading of the container if it is a high-value shipment.

- Ensure that you have discussed insurance terms with the supplier and your freight forwarder. Understand who owns what and at which point of the journey.

Simplify your trade – choose hassle-free shipping and importing from China to the UK. Click here to find out more!

OK, we have our container on a boat; the freight forwarder has informed us of the landing date. The ship is chugging along through the straights of Singapore towards the Suez canal (or round the horn… who knows), and you are sat at home twiddling your thumbs awaiting your delivery.

However, before the ship lands in the UK, there are a few items that you want to be ensuring you have conducted.

Understanding Import Charges

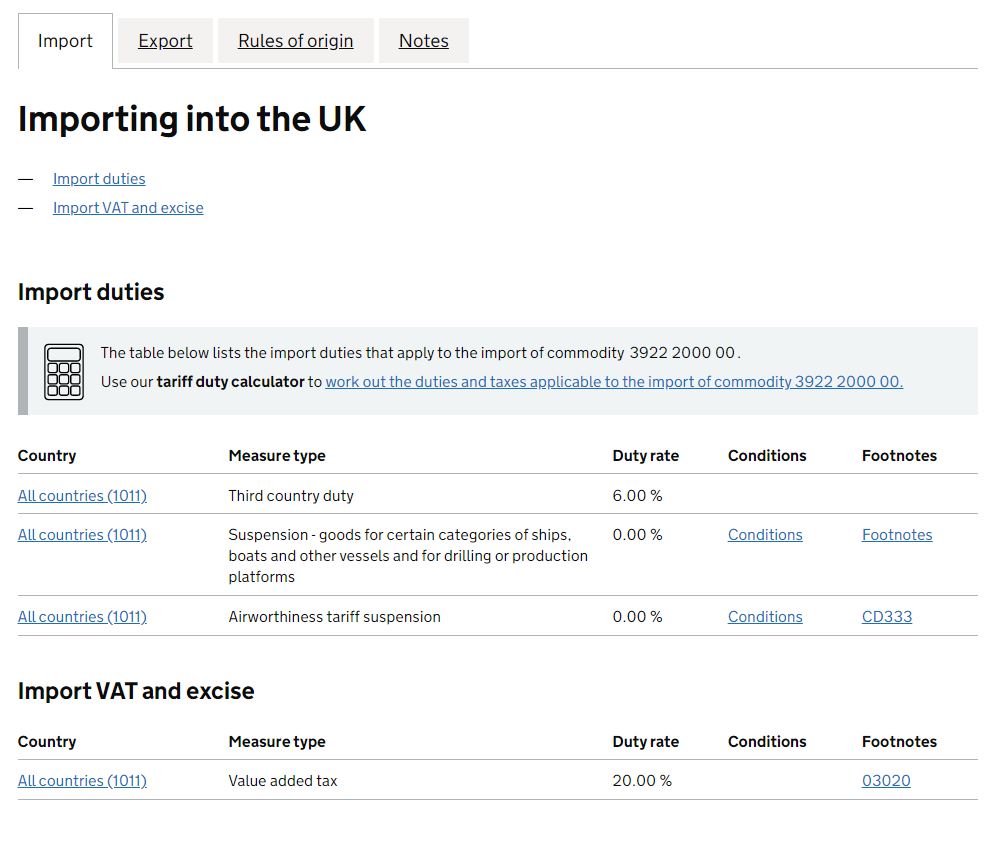

Usually, your shipping agent will pay these for you and then charge you a percentage of the fee. But it’s good to know how to calculate the rate of duty and applicable VAT.

Import Duty

So the first items we want to calculate is our duty to be paid.

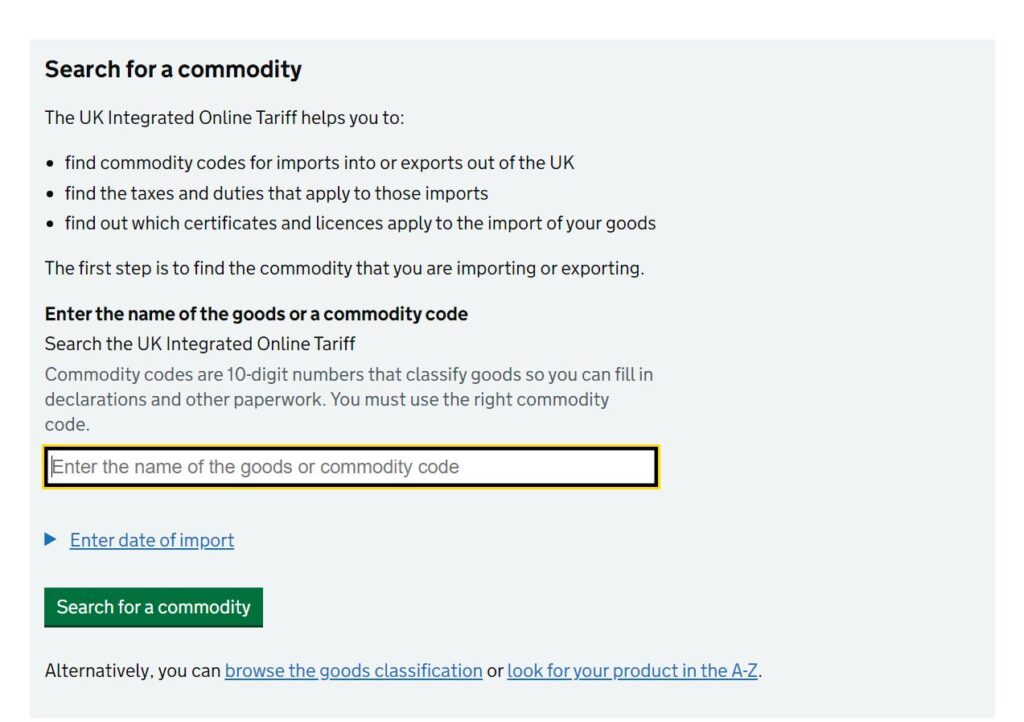

To do this, we take the HS code that we gained from the exporting and invoice documents. Then we head over to the UK trade tariff lookup tables.

We add our HS code number into the search bar and click search. It may take you to exactly your article or you may have to go and do a bit of digging. Either way, after finding your exact code or description, you should be given two useful percentages that we need to make a note of.

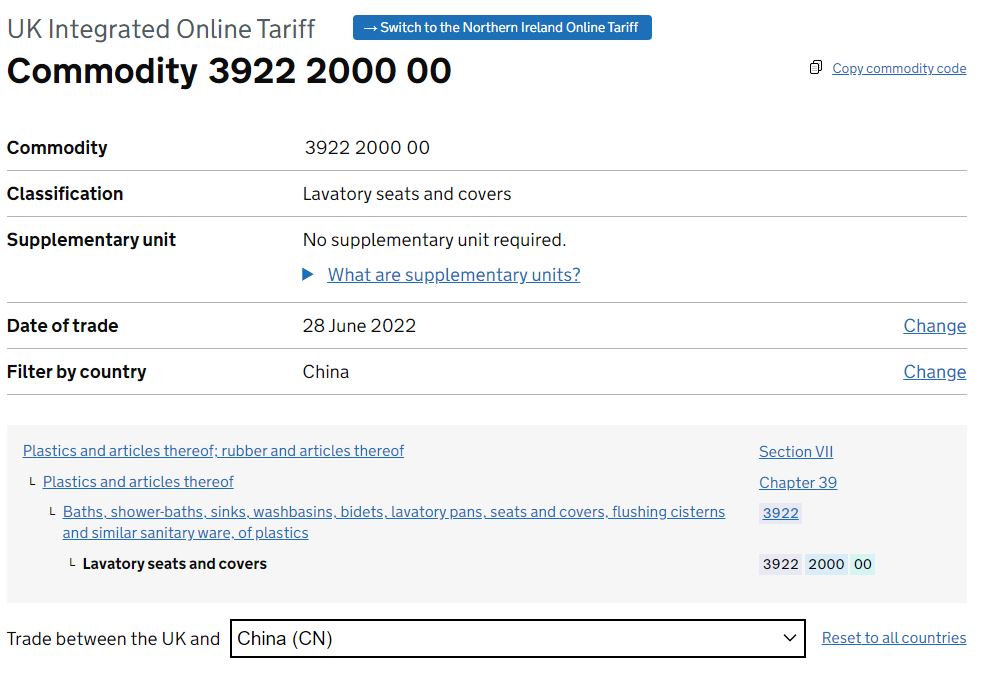

As an example, I am going to use a toilet seat. So in the trade tariff database, we find that a Toilet seat- also known as a lavatory seat, has an HS code of 3922200000 and an import duty of 6% and a VAT tariff of 20%.

We use these two numbers in different ways to calculate our total landed cost.

The first thing we need to calculate is our duty. Our duty is taken from above our 6% and calculated against our CIF value.

Embark on Your Importing Journey!

What is CIF then: it stands for cost insurance and freight. It’s the cost of our products, the cost of insurance and the cost of freight.

So let’s take a toilet seat as an example.

Let’s say as an easy-to calculate example we had a stock value of £5,000 in stock, our freight of these toilet seats cost £3,000 and insurance £100 In total we would be looking at a duty of:

£5000+£3000+£100= £8100

£8100 x 0.06= £486

So there we have our duty rate.

£486 for our duties on our shipment of toilet seats.

Calculating VAT

Next, we need to calculate our VAT. To calculate our VAT rate, we need to find out our total value. To calculate the total value we do:

Value of goods + Shipping+ Insurance+ Duties.

So from our toilet seat example, we will have the following:

£5000 + £3000 + £100 + £486= £8586

We have a total value of £8,586.

We need to calculate 20% of this value to give us our VAT rate, remember we got our VAT rate from the Trade Tariff calculator.

So we do £8586 x 0.2 = £1,717.20

Add them together:

£8586 + 1717.20= £10,303.20

Reducing some of the fee's you have to pay

So after we have calculated our landed costs, we then have to pay the fees. Now, here it has to be said that our shipping agent will usually pay this fee on our behalf and then bill us for it unless you have chosen otherwise. They will, of course, charge us for the privilege. It’s usually around 5% of the fees. So bear that in mind when calculating your landing costs.

Before the items have landed before the agent has shipped them to our warehouse or chosen place. We can look at how to reduce some of these fees.

OK, so, if you have a VAT-registered company, we can apply for what is known as an EORI number. EORI stands for Economic Operators Registration and Identification Number. And we can assign our delivery against this number, which means that when the components have been imported, and VAT paid, we can claim them back. Just like you would on any other VAT purchase for your company.

Ensure you provide your shipping agent with the EORI before import, though, as this value of VAT is assigned to your number, you will be able to claim it back at a later date.

Landing

So all being well, you have had your delivery sent to your warehouse, it’s been offloaded and you can now start to reap the rewards of those hard-earned sleepless nights.

It’s honestly not as hard as it seems to start out and entirely within your grasp to press ahead and start that new online business.

🌟 Ready to Transform Your Importing Journey? Let’s Make It Happen! 🚀

Hey there, aspiring importers and savvy business owners! Are you feeling overwhelmed by the labyrinth of importing goods from China to the UK? Worry no more! We’ve decoded the complex world of VAT, import duties, and the UK Trade Tariff System just for you.

Why Choose Us?

- Expertise: We’re not just advisors; we’ve been in your shoes. Our firsthand experience in navigating the intricate process of importing, coupled with our deep understanding of the UK Trade Tariff System, sets us apart.

- Simplicity: Our detailed guides and videos demystify the entire process, transforming what seems like a daunting task into a manageable and clear journey.

- Efficiency: With our strategies, you’ll not only save money but also streamline your importing process, ensuring your business stays competitive and profitable.

- Support: Have questions or need a personalized touch? We’re just a message away, ready to offer tailored advice and solutions that fit your unique needs.

But Wait, There’s More!

- Comprehensive Services: From supplier due diligence to ensuring compliance with all required certifications, we’ve got you covered. Our all-encompassing service includes China export, shipping, UK import, and final delivery to your doorstep or warehouse.

- Hassle-Free Experience: Forget the complexities of dealing with multiple suppliers and confusing payment structures. With us, you get a clear, straightforward invoice and a seamless service, leaving you to focus on what you do best – growing your business!

Take the Leap with Confidence This is your moment to shine in the importing world. Say goodbye to sleepless nights and hello to a smooth, successful importing experience. Your business deserves the best, and we’re here to deliver just that.

Explore Our Services & Get Started

Join the ranks of successful importers who have mastered the art of importing from China to the UK with our expert guidance. Let’s turn your ambitions into achievements, together!