Decoding HS Codes: A Sky-High Guide to the UK Trade Tariff

Setting Sail into the World of HS Codes

Ahoy, trade enthusiasts! Today, we embark on a journey through the clouds of international commerce, navigating the intricacies of HS codes and unravelling the secrets of the UK Trade Tariff. HS codes, those numerical gatekeepers of global trade, hold the key to a smooth voyage through customs.

Understanding the Significance of HS Codes

At its core, an HS (Harmonized System) code is an internationally recognized reference number that classifies specific products for import and export. Think of it as a global language for trade, ensuring that goods are accurately categorized across borders. Finding the right HS code is not just a formality – it’s the compass that guides your cargo through the seas of Customs Duty, import VAT, and various taxes.

The Role of the UK Trade Tariff: Your Navigator in the Clouds

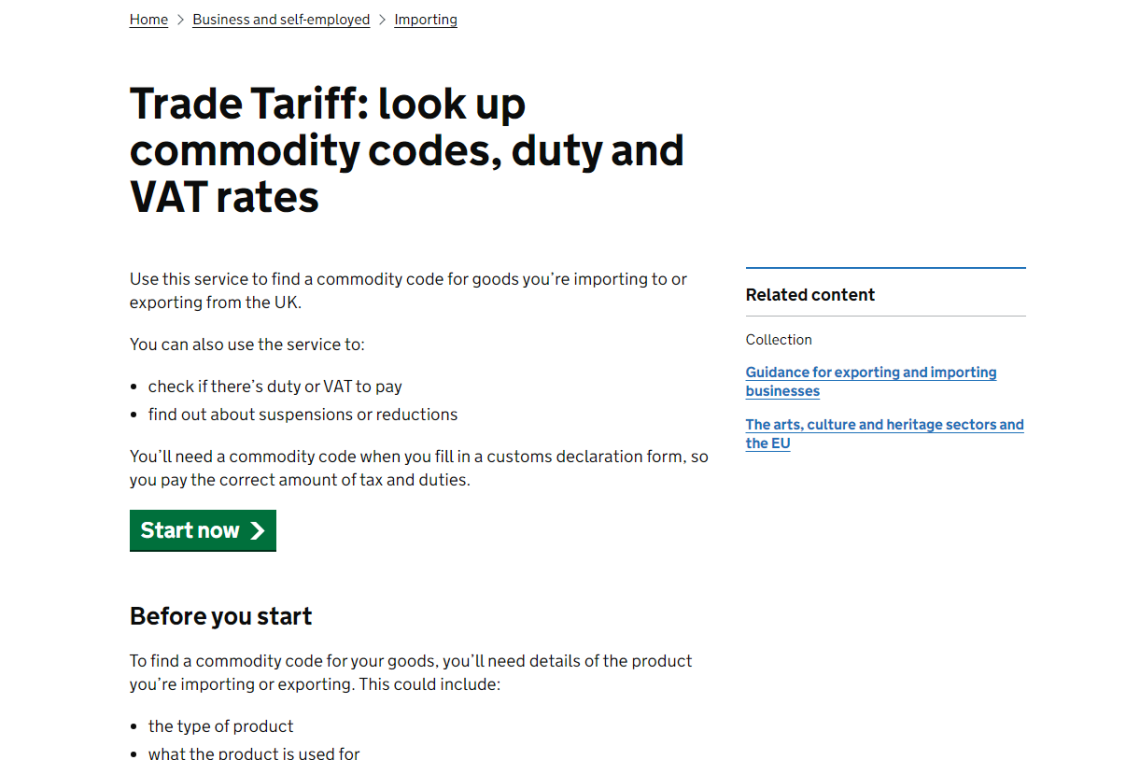

In the UK, the official source for HS codes is the UK Trade Tariff. This digital treasure trove acts as your navigator, helping you unearth the correct code for your goods. Here’s how it works:

1. Navigating the Trade Tariff Tool:

Visit the official website (https://www.gov.uk/trade-tariff) and familiarize yourself with the user-friendly interface. Use the search function or explore the chapters and sections to locate the category that best describes your product.

2. Drilling Down into Subheadings:

Within each chapter, you’ll find subheadings that further refine the classification. Carefully review the descriptions to determine the most accurate subheading for your goods.

3. Verifying with Additional Information:

HS codes can be intricate, and the Trade Tariff tool provides additional information such as explanatory notes, legal text, and updates. Verify your selection to ensure accuracy.

4. Utilizing Online Tools:

Consider leveraging online tools that complement the Trade Tariff. Some platforms allow you to search for HS codes based on product descriptions, providing an additional layer of assurance.

Challenges in Classification and Additional Resources

Classifying goods can be complex, especially for certain categories. The UK government offers specific guidelines for challenging items, including ceramics, electronics, pharmaceuticals, and more. Before diving into the Trade Tariff, familiarize yourself with these resources for a smoother classification process.

International Harmony: HS Codes Worldwide

While many countries follow the same classification system, it’s essential to note that only the first 6 digits of the HS code are standardized globally. Product-specific decisions may vary from country to country. If relying on a code from an overseas supplier, verify its compatibility with UK regulations.

Smooth Sailing with Expert Guidance!

Navigating the HS code seas can be challenging, and we’re here to help make your journey smoother. If you find yourself in need of expert guidance or personalized assistance in selecting the right HS code for your products, don’t hesitate to get in touch with us. Our team of experts is ready to steer you through the classification process and ensure your trade ventures are prosperous and hassle-free.

May your codes be accurate, your customs declarations seamless, and your trade ventures prosperous!